is new mexico tax friendly for retirees

Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to. As of November 2020 the unemployment rate in New Mexico was back down to 75 percent.

How To Minimize Social Security Taxes

Is New Mexico Tax Friendly For Retirees.

. A one-time refundable income tax rebate of 500 for. Now this is still a far cry from the pre-COVID rate of 48 percent. December 14 2021 by Shelia Campbell.

Withdrawals from retirement accounts are not taxed. Well explain what makes a state tax-friendly which states are the most. See a Full Table of all 50 States Showing How Each State Taxes Retirement Income Plus Military Pension.

New Mexico is moderately tax-friendly for retirees. New Mexico is moderately tax-friendly for retirees. Depending on local municipalities the total tax rate can be as high as.

California is in the top three states that retirees are most likely to quit is new mexico. By Paul Arnold May 31 2022. Up to 10000 of military retirement pay is exempt.

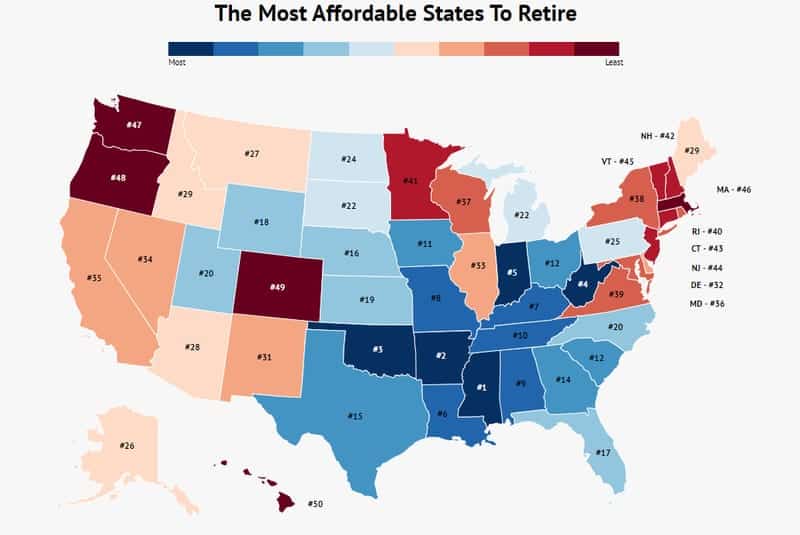

Most tax friendly Moderately tax friendly Least tax friendly. New Mexico is moderately tax-friendly for retirees. Social Security retirement benefits are taxable in New Mexico but they are also partially.

New Mexico is moderately tax-friendly for retirees. For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income. Social Security income is not taxed.

It does not have inheritance tax estate tax or franchise taxes. Does new mexico offer a tax break to retirees. New Mexico is moderately tax-friendly toward retirees.

Tennessee is tax-friendly toward retirees. New Mexico Starting in 2022 the Land of Enchantment offers a limited and temporary tax break for military pensions. New Mexico is moderately tax-friendly for retirees.

Only Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico North Dakota Rhode Island Utah Vermont and West Virginia currently tax Social. A new refundable child tax credit of up to 175 per child which will save New Mexico families 74 million annually. New Mexico sales tax details The New Mexico NM state sales tax rate is currently 5125.

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly opens in new tab and the 10 least tax-friendly states for. For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income. New Mexico is moderately tax-friendly toward retirees.

It is also above. Does New Mexico offer a tax break to retirees. New Mexico is well known for its low costing of living which is 31 lower than the average in the United States.

Social Security income is partially taxedWages are taxed at normal rates and. Its important to note that New Mexico does tax retirement income including Social Security. Is New Mexico tax-friendly for retirees.

Well explain what makes a state tax-friendly which states are the most tax-friendly for retirees and touch on the importance of property tax relief.

The Absolute Cheapest States To Retire In 2020 Zippia

Social Security Income Tax Exemption Taxation And Revenue New Mexico

The 10 Best Places To Retire In New Mexico In 2022 Personal Capital

New Mexico State Veteran Benefits Military Com

Retiring In New Mexico A Good Idea Albuquerque Journal

10 Pros And Cons Of Living In New Mexico Right Now Dividends Diversify

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

New Mexico Estate Tax Everything You Need To Know Smartasset

11 Pros And Cons Of Retiring In New Mexico Retirepedia

Taxes In Mexico Great Info For Us Expats 2021 International Living

Maximize Social Security Benefits In New York

15 States That Don T Tax Retirement Income Pensions Social Security

10 Pros And Cons Of Living In New Mexico Right Now Dividends Diversify

These States Don T Tax Military Retirement Pay